Starting with dental insurance plans humana, this topic delves into the various aspects of coverage, network, cost, and benefits provided by Humana, offering a detailed insight into what they offer.

Exploring the range of dental insurance plans available, this discussion aims to provide a comprehensive understanding of Humana’s offerings and how they can benefit individuals and families.

Overview of Humana Dental Insurance Plans

Humana offers a variety of dental insurance plans to meet the diverse needs of individuals and families. These plans provide coverage for preventive, basic, and major dental services, ensuring comprehensive oral health care.

Types of Dental Insurance Plans

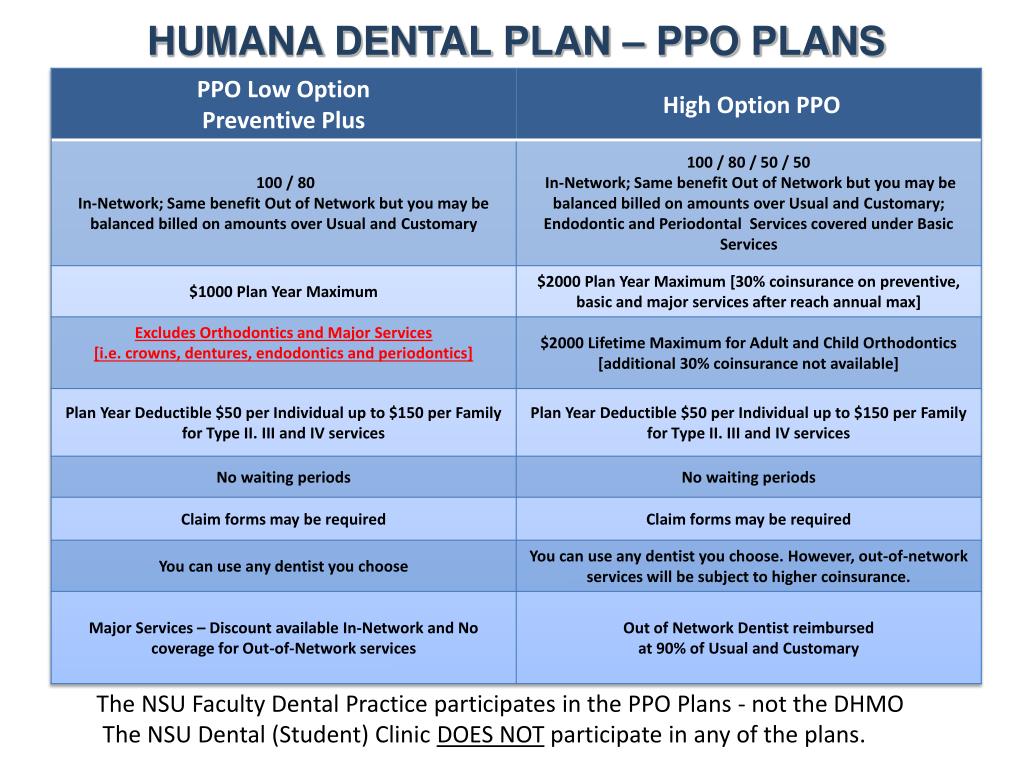

- Preferred Provider Organization (PPO) Plans: These plans offer a network of dentists that members can choose from for their dental care needs. Members have the flexibility to visit out-of-network dentists as well.

- Dental Health Maintenance Organization (DHMO) Plans: DHMO plans require members to choose a primary care dentist from a network of providers. Referrals are needed to see specialists.

- Discount Dental Plans: These plans offer discounts on dental services at participating dentists. Members pay a discounted fee for covered services.

Coverage Options

- Preventive Services: Coverage for routine exams, cleanings, and X-rays to help maintain oral health.

- Basic Services: Coverage for fillings, extractions, and other common dental procedures.

- Major Services: Coverage for more complex procedures like root canals, crowns, and bridges.

Benefits of Choosing Humana

- Wide Network: Humana has a large network of dentists across the country, providing members with access to quality care.

- Cost Savings: With various plan options, members can find a plan that fits their budget while still receiving comprehensive coverage.

- Customer Service: Humana offers excellent customer service to assist members with any questions or concerns regarding their dental insurance.

Network Coverage: Dental Insurance Plans Humana

When it comes to network coverage, Humana dental insurance plans offer access to a wide network of dentists and specialists across the country. This network includes both general dentists for routine check-ups and cleanings, as well as specialists for more complex procedures like orthodontics or oral surgery.

In-Network vs. Out-of-Network Coverage

In-network providers are dentists and specialists who have agreed to accept negotiated rates from Humana, which can result in lower out-of-pocket costs for members. On the other hand, out-of-network providers may charge higher fees, leading to higher expenses for the insured individual. It is important to check with Humana to see which providers are in-network to maximize your benefits.

Finding a Dentist that Accepts Humana Insurance

To find a dentist that accepts Humana insurance, you can use the provider search tool on the Humana website. Simply enter your location and the type of dentist you are looking for, and the tool will provide you with a list of in-network providers in your area. You can also contact Humana customer service for assistance in finding a dentist that accepts your insurance plan.

Cost and Pricing

When it comes to Humana dental insurance plans, understanding the costs involved is crucial for individuals and families looking to budget for their dental care needs. Let’s break down the various costs associated with Humana dental insurance plans and explore how much individuals or families typically pay for coverage.

Premiums

Premiums are the monthly payments you make to maintain your dental insurance coverage with Humana. The cost of premiums can vary based on the specific plan you choose, your location, and other factors. On average, individuals can expect to pay anywhere from $20 to $50 per month for basic coverage, while family plans may range from $50 to $150 per month.

Deductibles

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. With Humana dental insurance plans, deductibles typically range from $50 to $150 per year for individuals and $150 to $450 per year for families.

Copays and Coinsurance, Dental insurance plans humana

Copays are fixed amounts you pay for specific dental services, while coinsurance is a percentage of the cost you are responsible for. For example, a basic cleaning may have a $20 copay, while more extensive procedures may require coinsurance of 20% to 50%. These costs can add up depending on the services you require.

Cost-Saving Options

Humana offers various discounts and cost-saving options to help individuals and families manage their dental care expenses. These may include discounts for using in-network providers, preventive care incentives, and savings on additional dental services. Taking advantage of these options can help reduce the overall cost of your dental care.

Additional Benefits and Features

When it comes to Humana dental insurance plans, there are several additional benefits and features that go beyond basic coverage. These extra perks can help you maintain good oral health and overall well-being. Let’s explore some of the key benefits offered by Humana.

Preventive Care

Humana dental plans often include coverage for preventive care services such as regular cleanings, exams, and X-rays. These services can help you catch dental issues early on and prevent more serious problems down the line.

Orthodontic Coverage

Some Humana dental plans also offer orthodontic coverage, which can help offset the cost of braces or other orthodontic treatments. This can be especially beneficial for families with children who may need orthodontic care.

Vision Benefits

In addition to dental coverage, some Humana plans also include vision benefits. This can include coverage for eye exams, glasses, and contact lenses. Having both dental and vision benefits in one plan can provide comprehensive coverage for your overall health.

Wellness Programs

Humana dental insurance plans may also offer wellness programs and perks to help you maintain a healthy lifestyle. This could include discounts on gym memberships, access to telehealth services, or resources for managing stress and mental health. These additional wellness benefits can complement your dental coverage and support your overall well-being.

End of Discussion

Concluding our discussion on dental insurance plans humana, it is evident that Humana offers a wide array of coverage options, network benefits, cost-saving opportunities, and additional features that make it a compelling choice for those seeking quality dental insurance.

Quick FAQs

How do I find a dentist that accepts Humana insurance?

To locate a dentist within Humana’s network, you can use their online provider directory or contact Humana’s customer service for assistance.

Are there any discounts available with Humana dental plans?

Humana may offer discounts or cost-saving options for preventive care, orthodontic services, and other dental treatments. It’s best to check with Humana directly for specific details on available discounts.