As three business insurance reviews covemarkets takes center stage, this analysis delves into the importance of reviewing insurance coverage, compares three top providers, gives an overview of Covemarkets, and examines customer feedback. This informative piece aims to guide businesses in making informed decisions about their insurance needs.

Importance of Business Insurance Reviews: Three Business Insurance Reviews Covemarkets

Business insurance reviews are crucial for ensuring that a company’s coverage aligns with its current needs and risks. By regularly reviewing insurance policies, businesses can proactively identify gaps in coverage, update policies to reflect changes in operations, and potentially save money by eliminating unnecessary or redundant coverage.

Benefits of Regularly Reviewing Insurance Policies

- Adjust Coverage to Match Business Growth: As businesses expand or diversify, their insurance needs evolve. Regular reviews help ensure that coverage levels are adequate to protect the company’s assets and operations.

- Stay Up-to-Date with Regulatory Changes: Insurance requirements and regulations can change over time. By reviewing policies regularly, businesses can ensure compliance with current laws and avoid penalties.

- Identify Cost-Saving Opportunities: Through careful review, businesses may discover opportunities to optimize their insurance coverage and reduce premiums without compromising protection.

Risks of Not Conducting Regular Insurance Reviews, Three business insurance reviews covemarkets

- Underinsurance: Failing to update insurance policies can lead to underinsurance, leaving a business vulnerable to financial losses in the event of a claim that exceeds the coverage limits.

- Overpayment: Without regular reviews, businesses may continue paying for coverage they no longer need or that duplicates existing policies, resulting in unnecessary costs.

- Lack of Coverage for Emerging Risks: New risks may emerge in the business environment, such as cyber threats or natural disasters. Without reviewing insurance policies, a business may not have adequate coverage for these evolving risks.

Comparison of Three Business Insurance Reviews Providers

When it comes to choosing a business insurance review provider, it’s important to consider the key features and services offered by different companies. Let’s take a look at three providers and compare what sets them apart from each other.

Provider A

- Provider A offers a user-friendly platform for businesses to compare and review insurance policies.

- They have a wide range of insurance providers in their network, allowing businesses to find the best coverage options.

- The customer service team at Provider A is known for their responsiveness and helpfulness in addressing any questions or concerns.

Provider B

- Provider B specializes in providing detailed and comprehensive analysis of insurance policies, helping businesses make informed decisions.

- They offer customized insurance solutions tailored to the specific needs of each business, ensuring optimal coverage.

- Provider B also provides risk management services to help businesses minimize potential losses and liabilities.

Provider C

- Provider C focuses on simplifying the insurance review process for businesses, making it easy to understand and navigate.

- They offer online tools and resources to help businesses compare quotes and coverage options quickly and efficiently.

- Provider C has a reputation for transparency and honesty in their reviews, providing businesses with reliable information.

Covemarkets

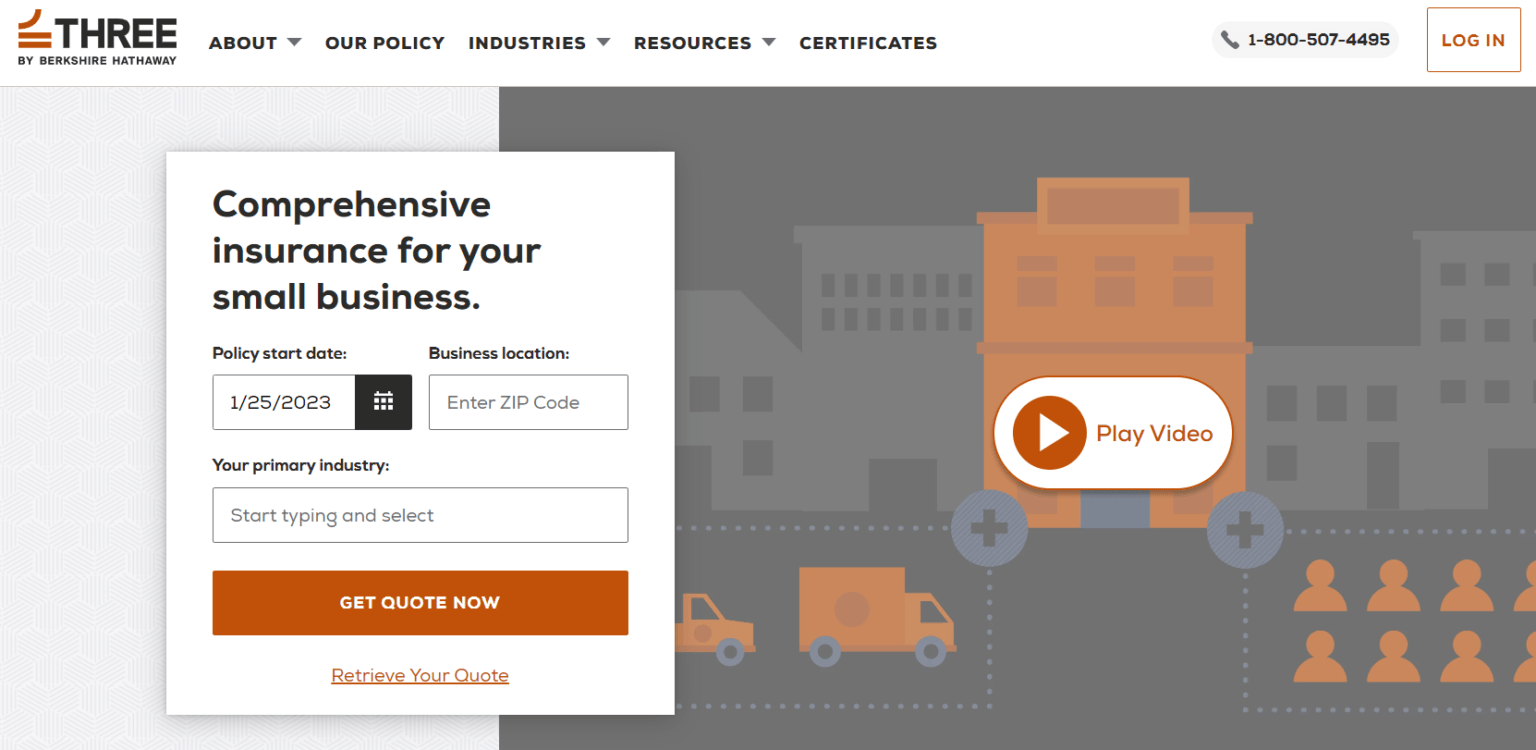

Covemarkets is an insurance marketplace that connects businesses with various insurance providers to help them find the right coverage for their specific needs. This platform simplifies the process of obtaining business insurance by offering a centralized location where businesses can compare different quotes and policies.

Overview of Covemarkets

Covemarkets streamlines the insurance shopping experience by allowing businesses to submit their information once and receive multiple insurance quotes from different providers. This saves time and effort compared to contacting individual insurers separately.

- Covemarkets offers a user-friendly interface that makes it easy for businesses to input their information and preferences.

- Businesses can compare quotes side by side to evaluate coverage options and pricing.

- The platform provides access to a wide network of insurance carriers, increasing the likelihood of finding competitive rates.

Advantages of Using Covemarkets

By utilizing Covemarkets, businesses can benefit from:

- Time savings: Instead of contacting multiple insurers individually, businesses can receive and compare quotes quickly through Covemarkets.

- Cost-effectiveness: The ability to compare multiple quotes helps businesses find competitive rates and save money on insurance premiums.

- Convenience: Covemarkets simplifies the insurance shopping process by offering a centralized platform for obtaining and comparing quotes.

Analyzing Customer Reviews of Covemarkets

When looking at customer reviews of Covemarkets, it is important to identify common themes, strengths, weaknesses, and positive experiences shared by customers.

Common Themes and Trends

- Many customers praise Covemarkets for their excellent customer service, citing quick responses and helpful staff.

- Some reviews mention the competitive pricing offered by Covemarkets compared to other insurance providers.

- Several customers highlight the easy and straightforward process of purchasing insurance through Covemarkets.

Strengths Highlighted in Customer Feedback

- Positive customer service experiences, with representatives going above and beyond to assist clients.

- Efficient claims processing and timely resolution of issues, leading to high customer satisfaction.

- Transparent pricing and policies, making it easy for customers to understand their coverage and options.

Weaknesses Highlighted in Customer Feedback

- Some customers mention delays in claims processing, leading to frustration and dissatisfaction.

- A few reviews point out limited coverage options compared to other insurance providers in the market.

- Difficulty reaching customer service during peak hours, resulting in longer wait times for assistance.

Examples of Positive Experiences

- A customer shared how Covemarkets helped them navigate a complex insurance claim, providing support every step of the way.

- Another client praised Covemarkets for their personalized approach, tailoring a policy to meet their specific business needs.

- One review highlighted the responsiveness of Covemarkets’ customer service team, resolving an issue promptly and professionally.

Conclusive Thoughts

In conclusion, understanding the significance of insurance reviews, comparing different providers, exploring Covemarkets, and learning from customer experiences are crucial steps for businesses seeking the right insurance coverage. By staying informed and proactive, businesses can protect themselves effectively in the ever-changing landscape of insurance.

FAQ Resource

Why is it essential for businesses to review their insurance coverage regularly?

Regular reviews help businesses stay updated on their coverage needs, ensure they are adequately protected, and potentially save costs by identifying gaps or redundancies.

What are the key factors businesses should consider when choosing an insurance review provider?

Businesses should consider factors such as the provider’s reputation, range of services offered, cost-effectiveness, customer support, and ability to tailor solutions to their specific needs.

How does Covemarkets simplify the process of obtaining business insurance quotes?

Covemarkets acts as an insurance marketplace, connecting businesses with multiple insurance providers, allowing them to compare quotes, coverage options, and make informed decisions conveniently.