Can you cancel claim car insurance? This topic delves into the process of canceling car insurance claims, reasons behind cancellation, consequences, and alternatives, providing a comprehensive guide for policyholders.

Exploring the intricacies of canceling a car insurance claim can shed light on crucial aspects that every driver should be aware of.

Understanding Car Insurance Claims Cancellation

When it comes to car insurance claims, there may be instances where policyholders need to cancel their claims for various reasons. Understanding the process, reasons, and consequences of canceling a car insurance claim is crucial for policyholders to make informed decisions.

Process of Canceling a Car Insurance Claim

- Policyholders can typically cancel their car insurance claims by contacting their insurance provider directly.

- It is important to provide all relevant details and reasons for canceling the claim to the insurance company.

- Once the claim is canceled, the policyholder may need to sign a form or provide written confirmation of the cancellation.

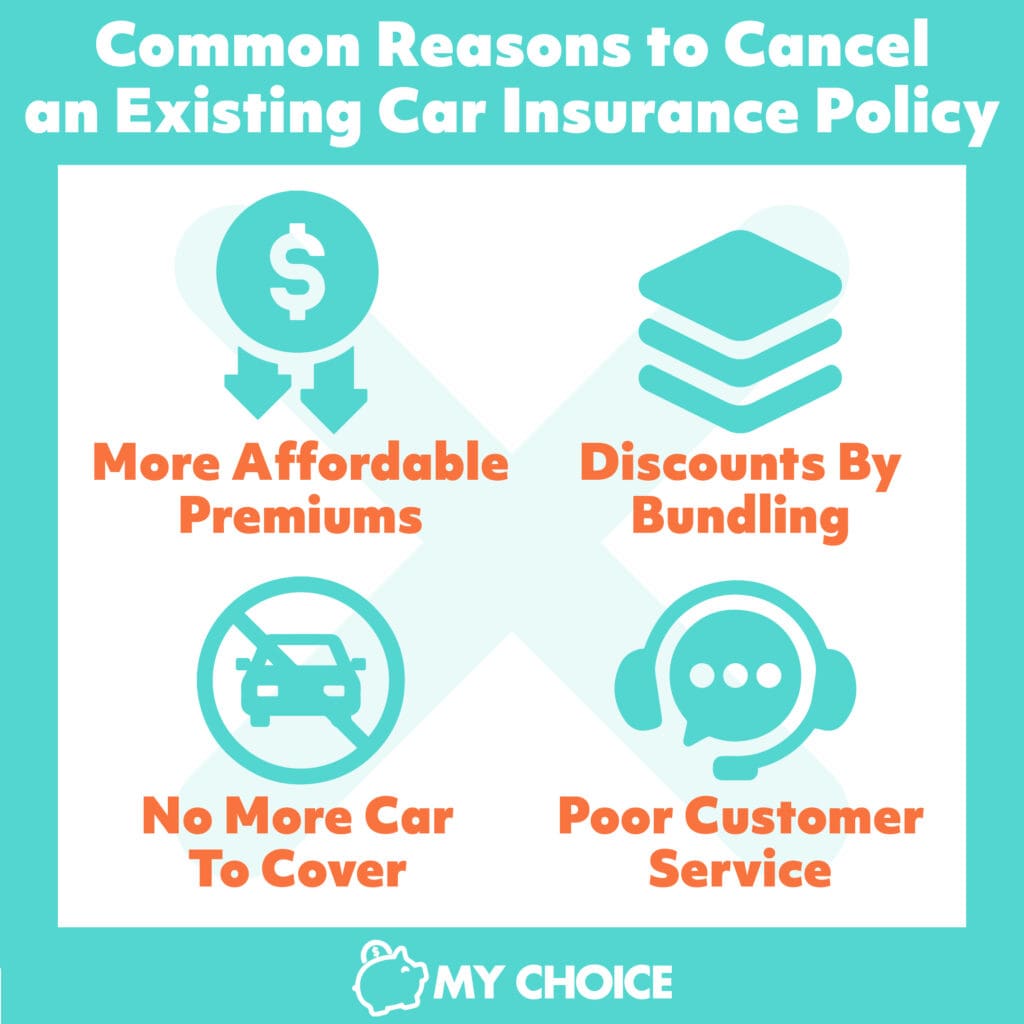

Reasons for Canceling a Car Insurance Claim

- Policyholders may realize that the damage to their vehicle is less severe than initially thought, making the claim unnecessary.

- If the cost of repairs is lower than the deductible amount, policyholders may choose to cancel the claim to avoid an increase in premiums.

- In some cases, policyholders may have found an alternative way to cover the costs of the damages, such as through a third party or out-of-pocket payment.

Consequences of Canceling a Car Insurance Claim

- Canceling a car insurance claim may not have a direct impact on the policyholder’s premiums, as long as the claim was not paid out.

- However, canceling a claim could affect the policyholder’s claims history and potentially raise red flags for future claims.

- Policyholders should consider the long-term implications of canceling a claim, as it could impact their ability to file claims in the future or receive coverage for certain incidents.

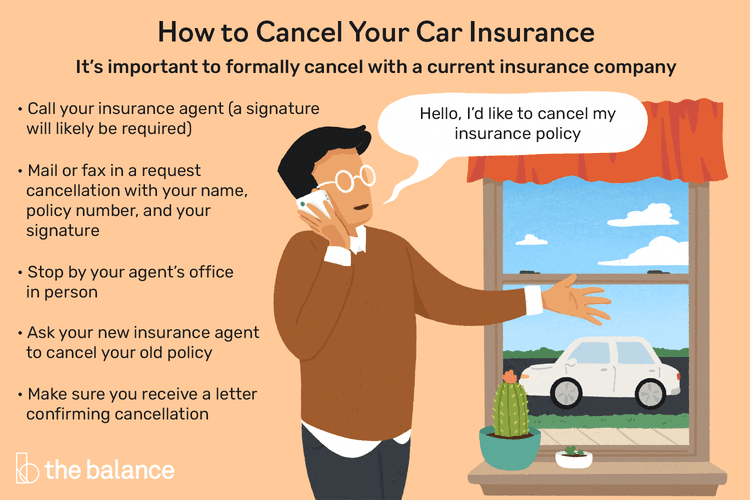

How to Cancel a Car Insurance Claim

Canceling a car insurance claim may be necessary for various reasons, such as deciding to pay out of pocket for minor damages or realizing that the claim was filed in error. Here are the steps involved in canceling a car insurance claim:

Step 1: Contact Your Insurance Provider

- Reach out to your insurance provider as soon as possible to inform them of your decision to cancel the claim.

- Provide your policy number and details of the claim for easy identification.

Step 2: Submit a Written Request

- Follow up with a written request to cancel the claim, detailing the reasons for cancellation.

- Include any relevant documentation, such as photos of the damages or any new information that may have come to light.

Step 3: Await Confirmation

- Wait for your insurance provider to confirm the cancellation of the claim in writing.

- Ensure that you receive written confirmation to avoid any misunderstandings in the future.

Documents Required to Cancel a Car Insurance Claim

- Policy number

- Details of the claim

- Written request for cancellation

- Any relevant documentation or evidence

Tips for Smoothly Canceling a Car Insurance Claim

- Act promptly and communicate clearly with your insurance provider.

- Provide all necessary information and documentation to support your request for cancellation.

- Follow up regularly to ensure that the claim cancellation process is moving forward.

- Keep a record of all communication and documentation related to the cancellation for your records.

Impact of Canceling a Car Insurance Claim

When it comes to canceling a car insurance claim, there are several factors that can influence future premiums, driver records, and insurance coverage. Understanding these impacts is crucial for making informed decisions regarding your car insurance policy.

Effect on Future Premiums

- Cancelling a car insurance claim may not directly impact your premiums in the short term, but it can affect your overall risk profile.

- Insurance companies consider your claims history when calculating premiums, so a pattern of canceling claims could signal to insurers that you are a higher risk.

- Repeatedly canceling claims may result in higher premiums or difficulty in obtaining coverage from certain insurers.

Impact on Driver’s Record

- Canceling a claim typically does not show up on your driving record, as long as the claim was not paid out.

- However, if a claim was already processed and then canceled, it may appear on your claims history, which could potentially impact your record.

- Having a history of canceled claims could raise red flags for insurers and affect your ability to secure favorable insurance rates in the future.

Influence on Insurance Coverage

- Canceling a claim does not necessarily affect your current insurance coverage, as long as the claim was not paid out.

- However, insurers may view frequent claim cancellations as a sign of potential fraud or abuse of the system, which could lead to coverage limitations or policy cancellations.

- It’s essential to weigh the benefits of canceling a claim against the potential long-term consequences on your insurance coverage and premiums.

Alternatives to Canceling a Car Insurance Claim

When faced with the decision of canceling a car insurance claim, there are alternatives that can be considered to effectively manage the situation without completely canceling the claim.

Adjusting the Claim Amount, Can you cancel claim car insurance

One alternative to canceling a car insurance claim is to adjust the claim amount. If you feel that the initial claim amount was too high or unnecessary, you can work with your insurance provider to modify the claim to a more accurate and reasonable amount.

Withdrawing a Claim

If you are unsure about canceling the claim but still feel that it may not be necessary, you have the option to withdraw the claim. Withdrawing a claim means that you are voluntarily pulling back the claim without canceling it completely, which can help avoid any negative repercussions on your insurance record.

Handling a Claim Without Canceling It

If you are hesitant to cancel the claim altogether, you can choose to handle the claim without canceling it. This involves working closely with your insurance provider to adjust the details of the claim, provide additional information or evidence, or explore other options to ensure a fair and accurate resolution without the need for cancellation.

Conclusive Thoughts

In conclusion, understanding the implications of canceling a car insurance claim is vital for making informed decisions about your coverage. By weighing the options and consequences carefully, you can navigate the process with confidence and clarity.

Questions and Answers: Can You Cancel Claim Car Insurance

How does canceling a car insurance claim affect future premiums?

Cancelling a car insurance claim may not directly impact future premiums, but it could affect your claims history and potentially lead to higher rates in the future.

Can cancelling a claim affect the driver’s record?

Canceling a claim may not show up on your driving record, but it could impact your claims history with the insurance company.

What are the best practices for canceling a car insurance claim smoothly?

Ensure you have all the necessary documents, communicate clearly with your insurance provider, and consider alternative options before making a final decision.

Are there alternatives to canceling a car insurance claim?

Yes, you can adjust the claim amount, withdraw the claim, or explore other options with your insurance provider to avoid canceling the claim altogether.