How much is auto insurance in Massachusetts? This question sparks curiosity and leads us into a detailed exploration of the various aspects surrounding auto insurance in the state. From legal requirements to average costs, we delve into essential information that every driver should know.

Overview of Auto Insurance in Massachusetts

Auto insurance is a crucial financial protection for drivers in Massachusetts, providing coverage in case of accidents, theft, or other damages. It ensures that drivers can cover the costs of repairs or medical expenses resulting from unforeseen incidents on the road.

Legal Requirements for Auto Insurance in Massachusetts, How much is auto insurance in massachusetts

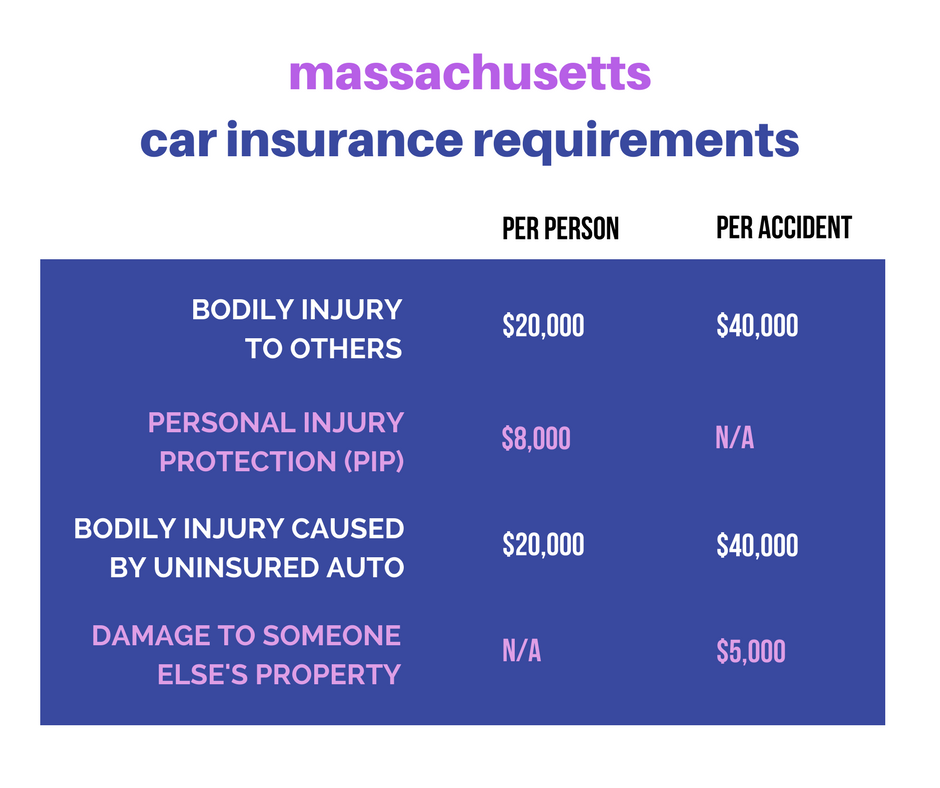

In Massachusetts, drivers are required by law to carry a minimum amount of auto insurance to legally operate a vehicle. The minimum coverage includes:

- Bodily Injury to Others: $20,000 per person and $40,000 per accident

- Personal Injury Protection (PIP): $8,000 per person, per accident

- Bodily Injury Caused by an Uninsured Auto: $20,000 per person and $40,000 per accident

- Damage to Someone Else’s Property: $5,000 per accident

Factors Influencing Auto Insurance Rates in Massachusetts

Several factors can influence the cost of auto insurance in Massachusetts, including:

- Driving Record: A history of accidents or traffic violations can lead to higher premiums.

- Age and Experience: Young drivers and inexperienced drivers may face higher rates.

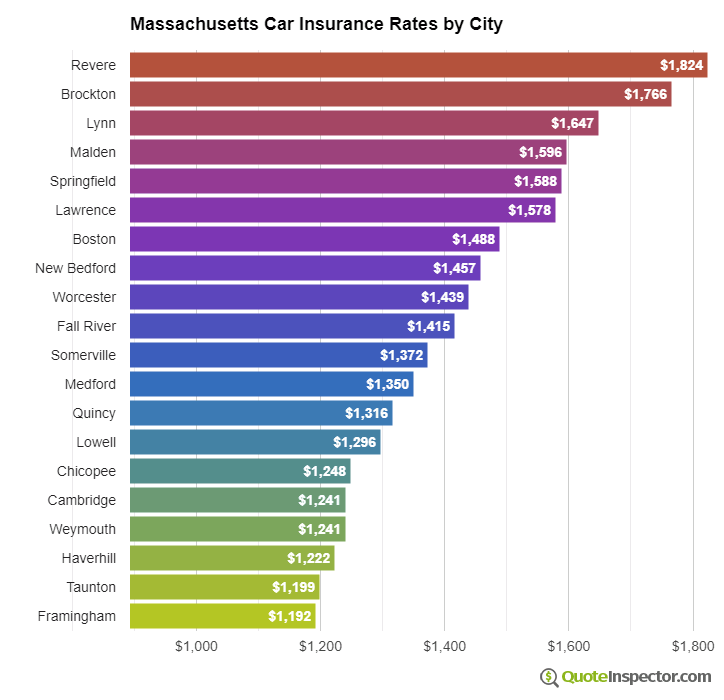

- Location: Urban areas with higher rates of accidents or theft may have higher premiums.

- Type of Vehicle: The make, model, and age of the vehicle can impact insurance rates.

- Coverage Limits: Higher coverage limits or additional coverage options can increase premiums.

Average Cost of Auto Insurance in Massachusetts

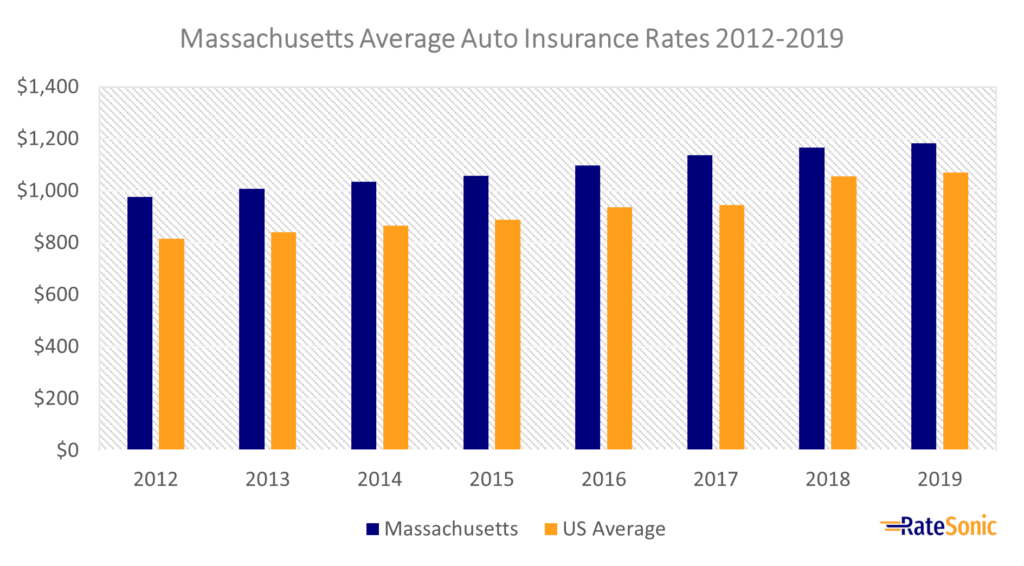

Auto insurance rates in Massachusetts can vary based on several factors. On average, the cost of auto insurance in Massachusetts is around $1,200 to $1,300 per year.

Factors Affecting Insurance Rates

Several factors can influence the cost of auto insurance in Massachusetts:

- Age: Younger drivers tend to pay higher premiums due to their lack of driving experience.

- Driving Record: A clean driving record can lead to lower insurance rates, while violations or accidents may result in higher premiums.

- Type of Coverage: The amount of coverage you choose, such as liability, comprehensive, or collision, can impact the cost of your insurance.

Comparison with Other States

When compared to other states, Massachusetts has relatively lower average auto insurance rates. States like Michigan, Louisiana, and Florida typically have higher average premiums due to various factors such as higher rates of accidents, uninsured drivers, and extreme weather conditions.

Types of Auto Insurance Policies Available

When it comes to auto insurance in Massachusetts, there are various types of policies available to drivers. Each type of policy offers different coverage options to protect you in case of an accident or other unforeseen events.

Liability Coverage

Liability coverage is mandatory in Massachusetts and helps cover the costs associated with injuries or property damage you cause to others in an accident where you are at fault. This type of coverage does not cover your own medical expenses or vehicle damage.

Comprehensive Coverage

Comprehensive coverage helps pay for damage to your vehicle that is not caused by a collision, such as theft, vandalism, or natural disasters. It provides coverage for a wide range of incidents that are not related to accidents involving other vehicles.

Collision Coverage

Collision coverage helps pay for repairs to your vehicle if you are involved in an accident with another vehicle or object. This coverage is especially beneficial if you have a newer car or a vehicle with a high value.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage helps protect you if you are in an accident with a driver who does not have insurance or enough insurance to cover your expenses. This coverage can help pay for medical bills, lost wages, and other damages.

Overall, having a combination of these different types of auto insurance policies can provide you with comprehensive coverage and financial protection in various scenarios on the roads of Massachusetts.

Tips for Saving on Auto Insurance: How Much Is Auto Insurance In Massachusetts

When it comes to auto insurance in Massachusetts, there are several ways residents can save money on their premiums. By taking advantage of discounts offered by insurance companies and improving driving habits, drivers can lower their insurance costs while still maintaining adequate coverage.

Take Advantage of Available Discounts

- Consider bundling your auto insurance with other policies, such as homeowners or renters insurance, to qualify for a multi-policy discount.

- Ask your insurance provider about discounts for safe driving habits, such as completing a defensive driving course.

- Explore discounts for having certain safety features installed in your vehicle, like anti-theft devices or anti-lock brakes.

- Check if you qualify for discounts based on your occupation, membership in certain organizations, or alumni associations.

Improve Driving Habits

- Obey traffic laws and avoid speeding tickets or other moving violations that can increase your insurance premiums.

- Avoid accidents by practicing defensive driving techniques, such as maintaining a safe following distance and staying alert behind the wheel.

- Consider using public transportation or carpooling to reduce the number of miles you drive, which can lower your insurance rates.

- Maintain a clean driving record over time to qualify for additional discounts and lower rates.

Epilogue

As we conclude our discussion on auto insurance in Massachusetts, it becomes evident that being informed about the costs, coverage options, and money-saving tips is crucial for all drivers in the state. Stay knowledgeable and make informed decisions to ensure you have the right protection on the road.

Q&A

What factors influence auto insurance rates in Massachusetts?

The factors that influence auto insurance rates in Massachusetts include age, driving record, type of coverage, and even the area where you live.

Are there specific discounts available for Massachusetts residents?

Yes, insurance companies in Massachusetts offer various discounts such as safe driver discounts, multi-policy discounts, and good student discounts.

How can improving driving habits help lower insurance costs?

Improving driving habits, such as avoiding speeding tickets and accidents, can lead to lower insurance costs over time as it demonstrates responsible driving behavior.